FORMS AND SCHEDULES INCLUDED IN THE EXPAT FLAT FEE RETURN PACKAGE

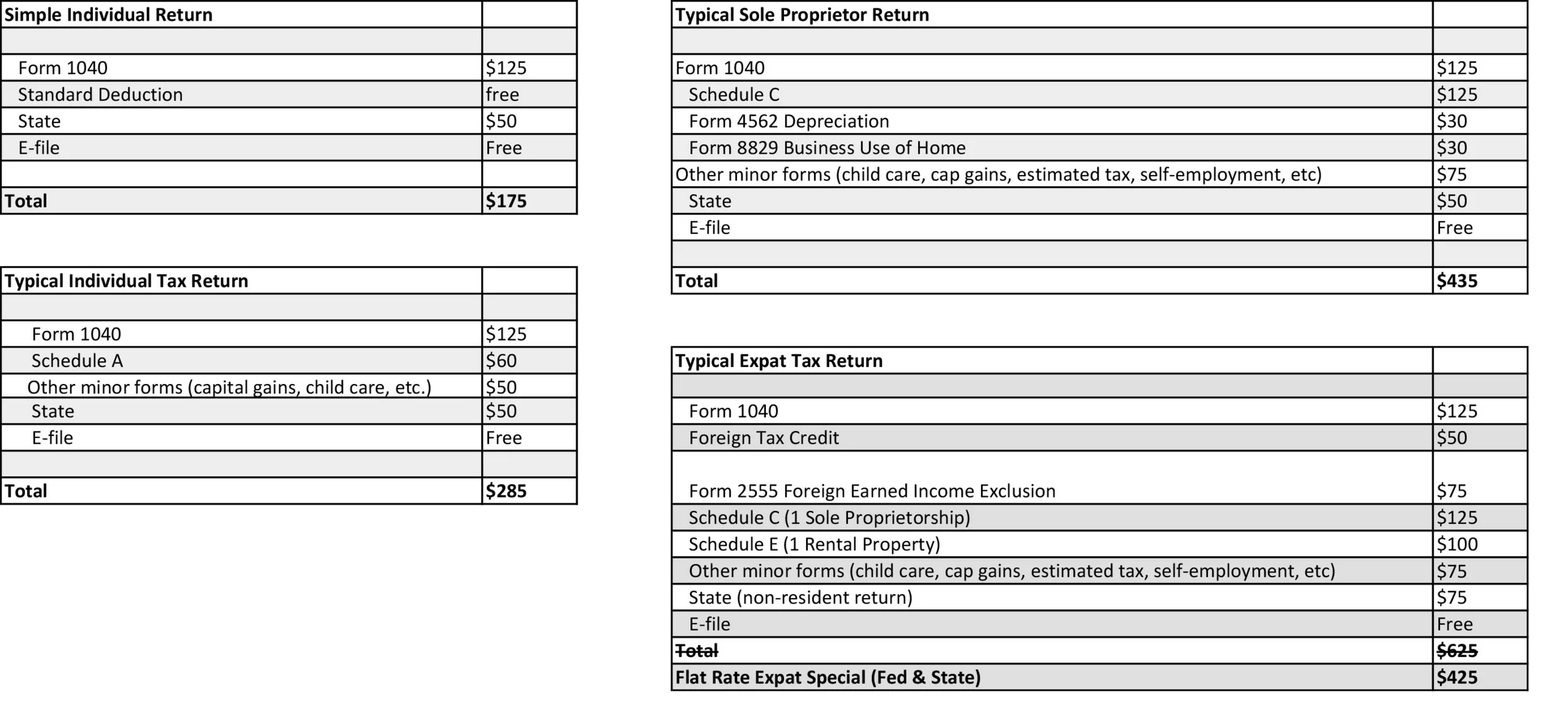

Tax Preparation Schedule of Fees by Form

Rates Effective January 1, 2018

1040

Individual Income Tax Return

1040-ES

Estimated Tax for Individuals

1040 EDEXP (1098-T)

Education Expenses Worksheet (1098-T Wkst)

1099DIV (WORKSHEET)

1099-DIV Dividends and Distribution Worksheet

1099G (WORKSHEET)

1099-G Government Payments Worksheet

1099INT (WORKSHEET)

1099-INT Interest Worksheet for Input

1099MISC (WORKSHEET)

1099-MISC Miscellaneous Income Worksheet

1099R (WORKSHEET)

1099-R Pension Worksheet

1116

Foreign Tax Credit (Individual, Estate, or Trust)

1116 AMT

Foreign Tax Credit Alternative Minimum Tax

8965

Health Care Coverage Exemption

2441

Child and Dependent Care Expenses

2555

Foreign Earned Income

3800

General Business Credit

3903

Moving Expenses

4137

Social Security and Medicare Tax on Unreported Tip

4562

Depreciation and Amortization

5405

Repayment of the First-Time Homebuyer Credit

5754

Statement by Person(s) Receiving Gambling Winnings

6198

At-Risk Limitations

6251

Alternative Minimum Tax - Individuals

8283

Noncash Charitable Contributions

8396

Mortgage Interest Credit

8582

Passive Activity Loss Limitations

8801

Credit for Prior Year Minimum Tax

8863

Education Credits

8880

Credit Qualified Retirement Savings Contributions

8903

Domestic Production Activities Deduction

8912

Credit to Holders of Tax Credit Bonds

8917

Tuition and Fees Deduction

8919

Uncollected SS and Medicare Tax on Wages

8949

Sales and Other Dispositions of Capital Assets

8959

Additional Medicare Tax

8960

Net Investment Income Tax

IRA/ROTH WORKSHEETS

IRA/Roth Worksheets

SCH 8812 1040/1040A

Child Tax Credit

SCH A (1040)

Itemized Deductions

SCH B (1040/1040A)

Interest and Ordinary Dividends

SCH D (1040)

Capital Gains and Losses

SCH E (1040) PAGE 1

Supplemental Income and Loss Page 1

SCH E (1040) PAGE 2

Supplemental Income and Loss Page 2

SCH EIC (1040/1040A)

Earned Income Credit - Child Information

SCH R (1040/1040A)

Credit for the Elderly or the Disabled

SCH SE (1040)

Self-Employment Tax